United State(s) of Cash

Digital currency is on the up and up, with more Americans using cashless payment methods to purchase goods and services than ever before.

Whether it’s a payment app like Venmo, a banking app, or even using their smartwatch with ApplePay–digital payment methods are being accepted at more businesses across the nation.

The COVID-19 pandemic fast-tracked the use of cashless payments when many stores temporarily stopped accepting cash in 2020.

We surveyed over 1,000 Americans to find out if they’ll stick with digital payments over cold-hard cash. The results reveal how Americans prefer to spend their money, and if we’re ready to be a fully cashless society.

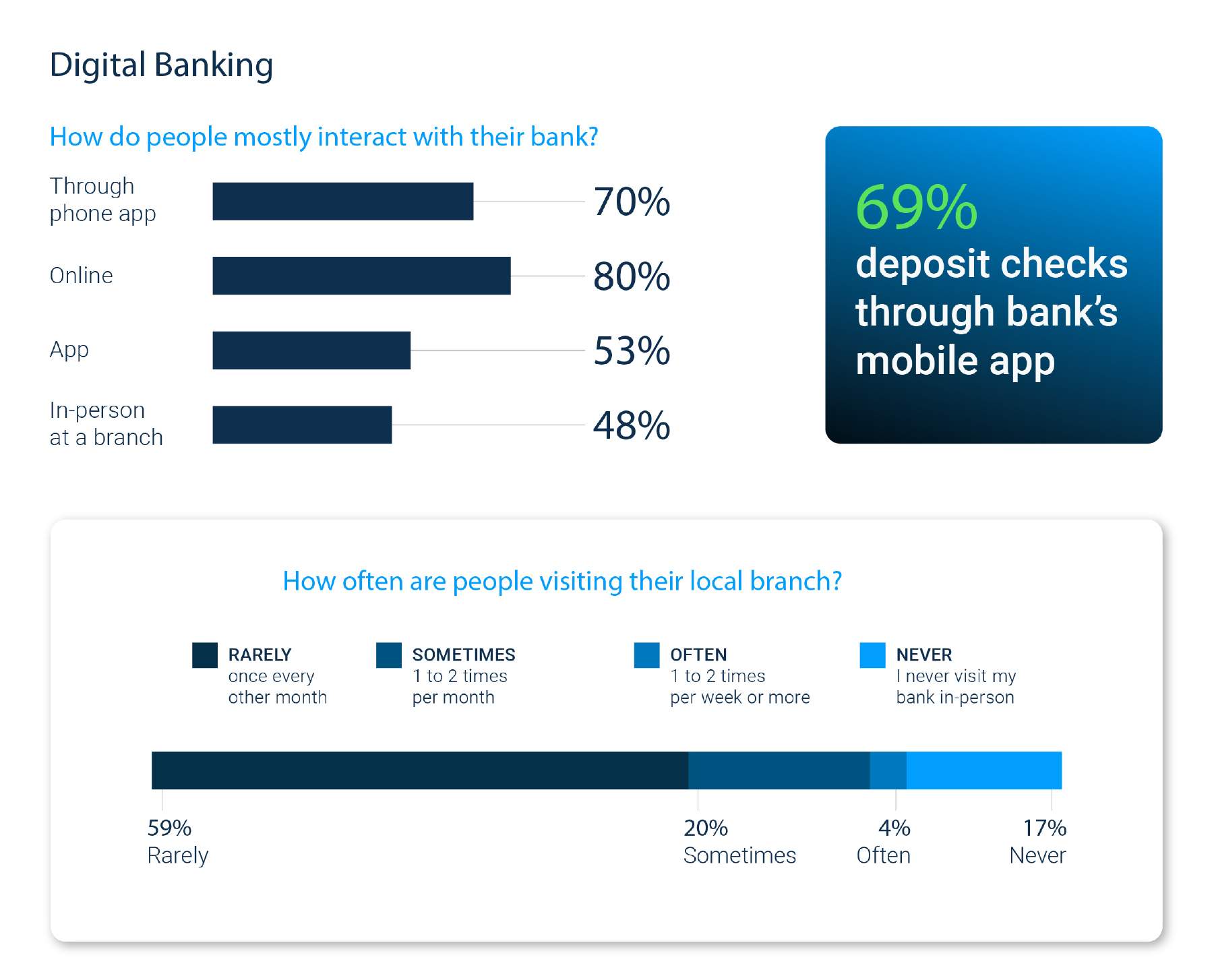

When it comes to banking, the convenience of online takes the cake. When asked how people interact with their bank, most say they use online banking (80%) or an app (53%), compared to 48% who say they mainly visit a branch.

If that wasn’t enough to show that online banking and apps are popular for customers, 69% say they deposit checks through their bank’s mobile app.

When asked how often they visit their local branch, 59% said rarely and 17% say never. One in five say they only go once or twice a month. A mere 4% say they often go to a branch once or twice a week.

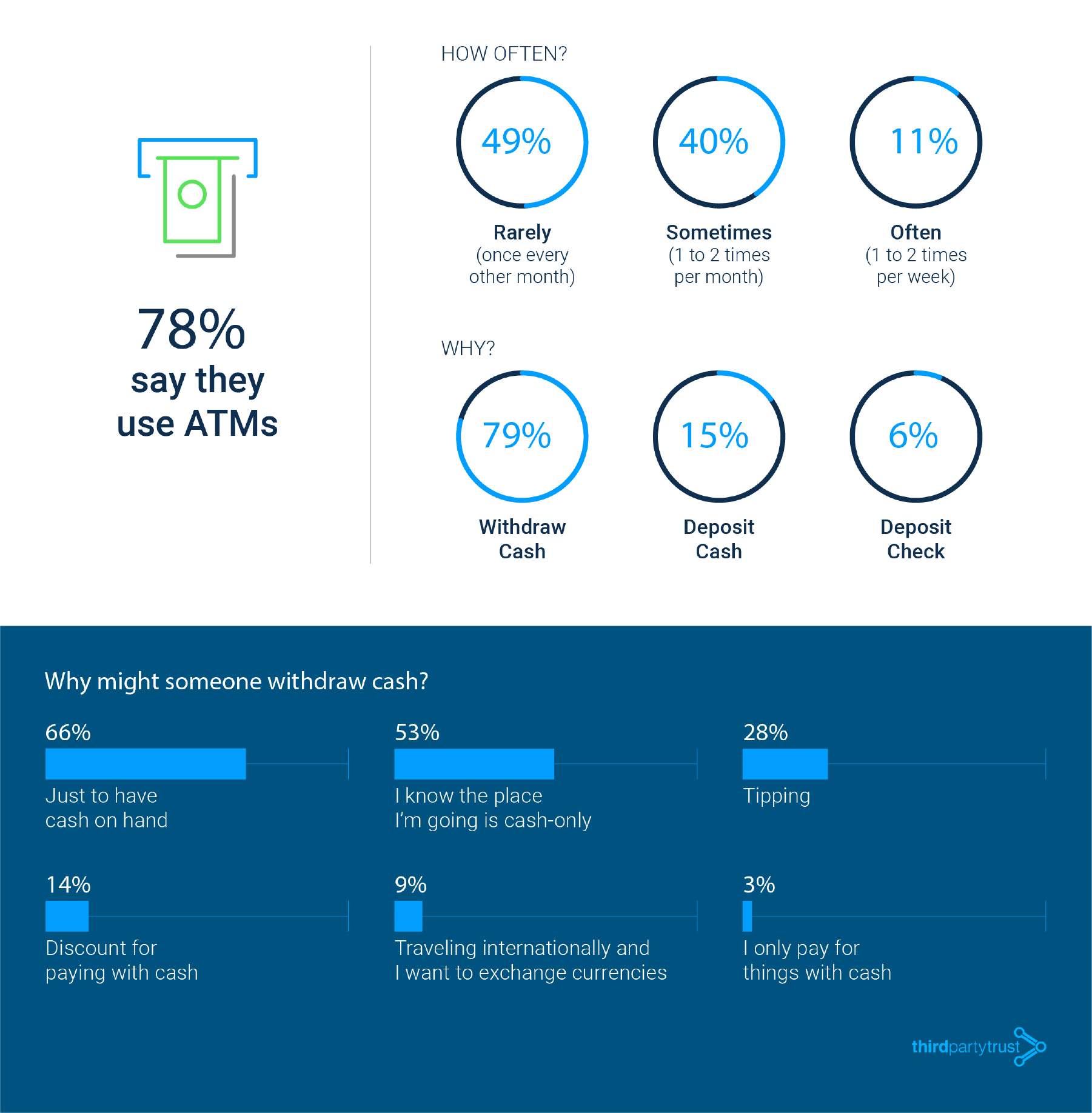

Even if it seems like cash is on the way out, 78% of Americans say they still use ATMs. 51% say they use ATMs at least once or twice a month, and as often as once or twice a week. Almost half (49%) say they rarely use ATMs, though.

Most people (79%) say they mainly use ATMs to withdraw cash. A lucky 15% say it’s usually to deposit cash, and 6% say it’s to deposit a check (newsflash–banking apps can actually do that without the hassle!)

When asked why they need to withdraw cash, most (66%) say it’s just to have it on hand, over half (53%) say it’s because they’re going somewhere that only accepts cash, and 28% say it’s for tipping. Other reasons include getting a discount for paying with cash (14%), exchanging it for foreign currency (9%), and a tiny amount (3%) say they pay for everything with cash.

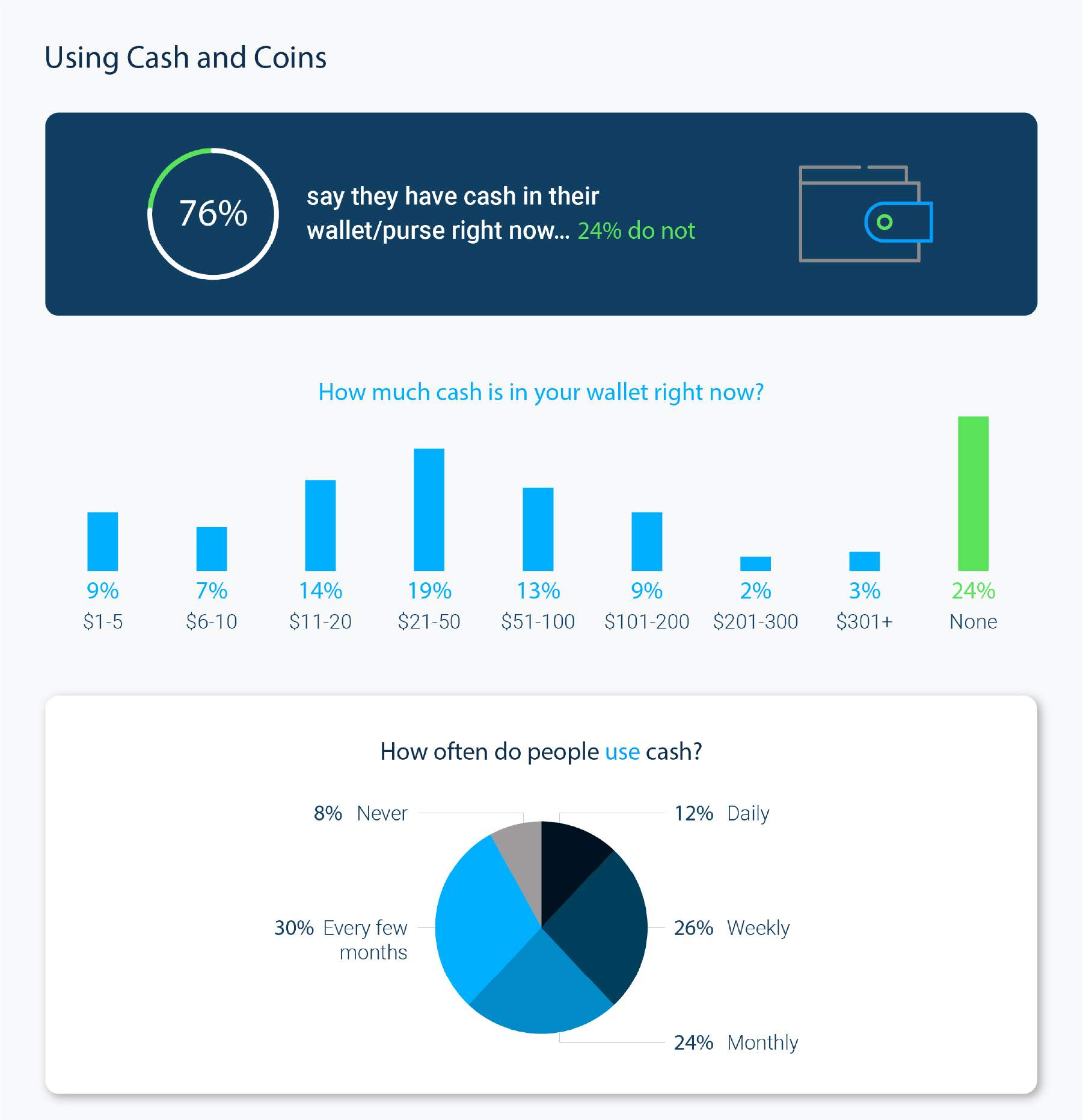

So now that we know how people interact with their banks–let’s talk about the cash(less?) habits of Americans. Surprisingly, almost one-quarter (24%) of Americans have no cash in their wallet or purse right now.

Of the 76% that do have cash on them at the moment, most have between $21 and $50. 14% have between $11 and $20, and 13% have between $51 and $100. A small fraction (5%) say they have between $201 and over $300 in their purse or wallet right now.

Do you remember the last time you paid for something in cash? Almost one-third (30%) say they only use cash every few months. 24% use cash monthly, 26% use cash weekly and 12% use cash daily. The remaining 8% say they never use cash when paying for anything.

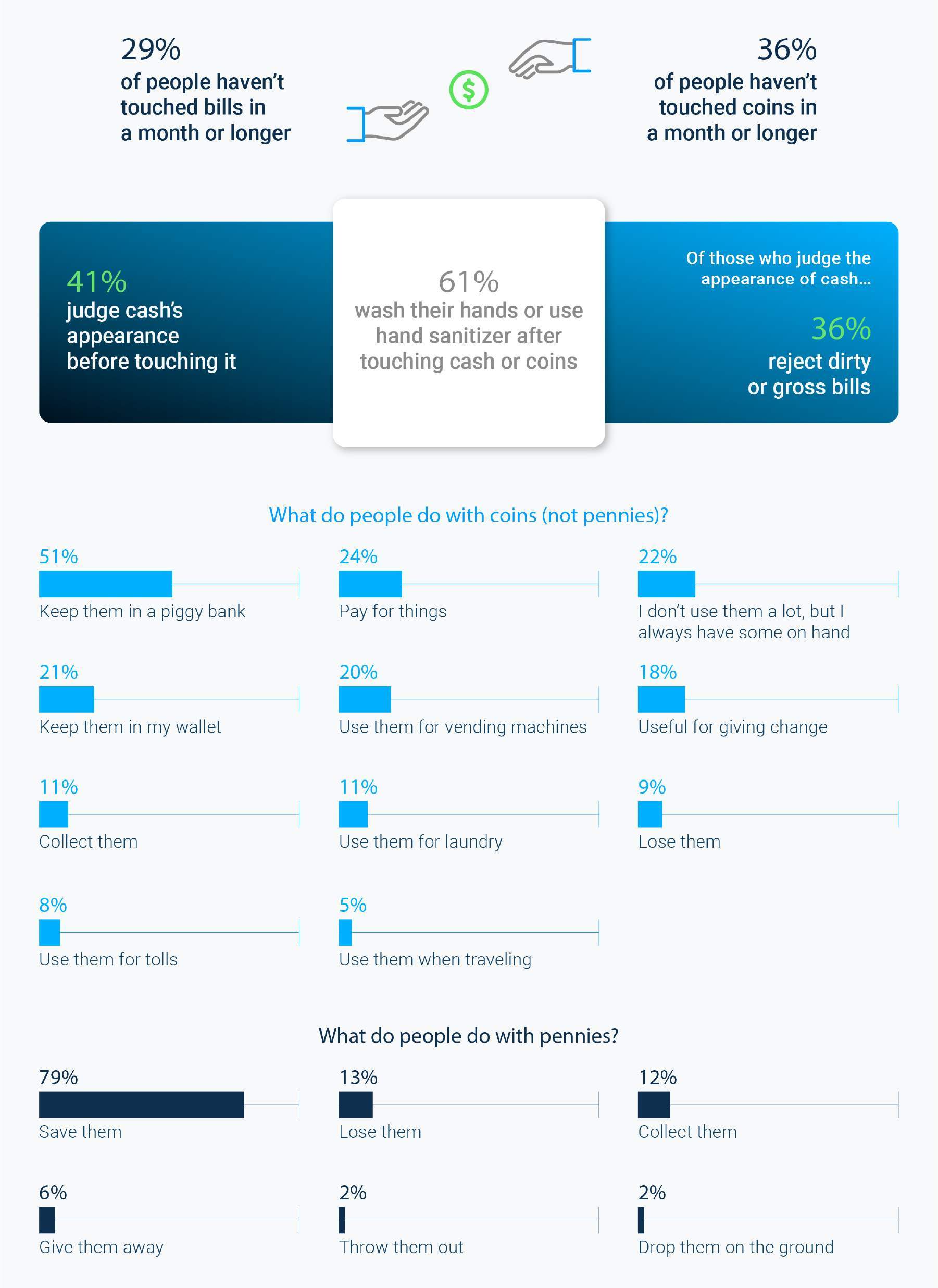

The pandemic put one thing into perspective for a lot of us: cash is dirty. 29% of Americans haven’t touched physical bills in a month or longer, and 36% haven’t touched coins in a month or longer.

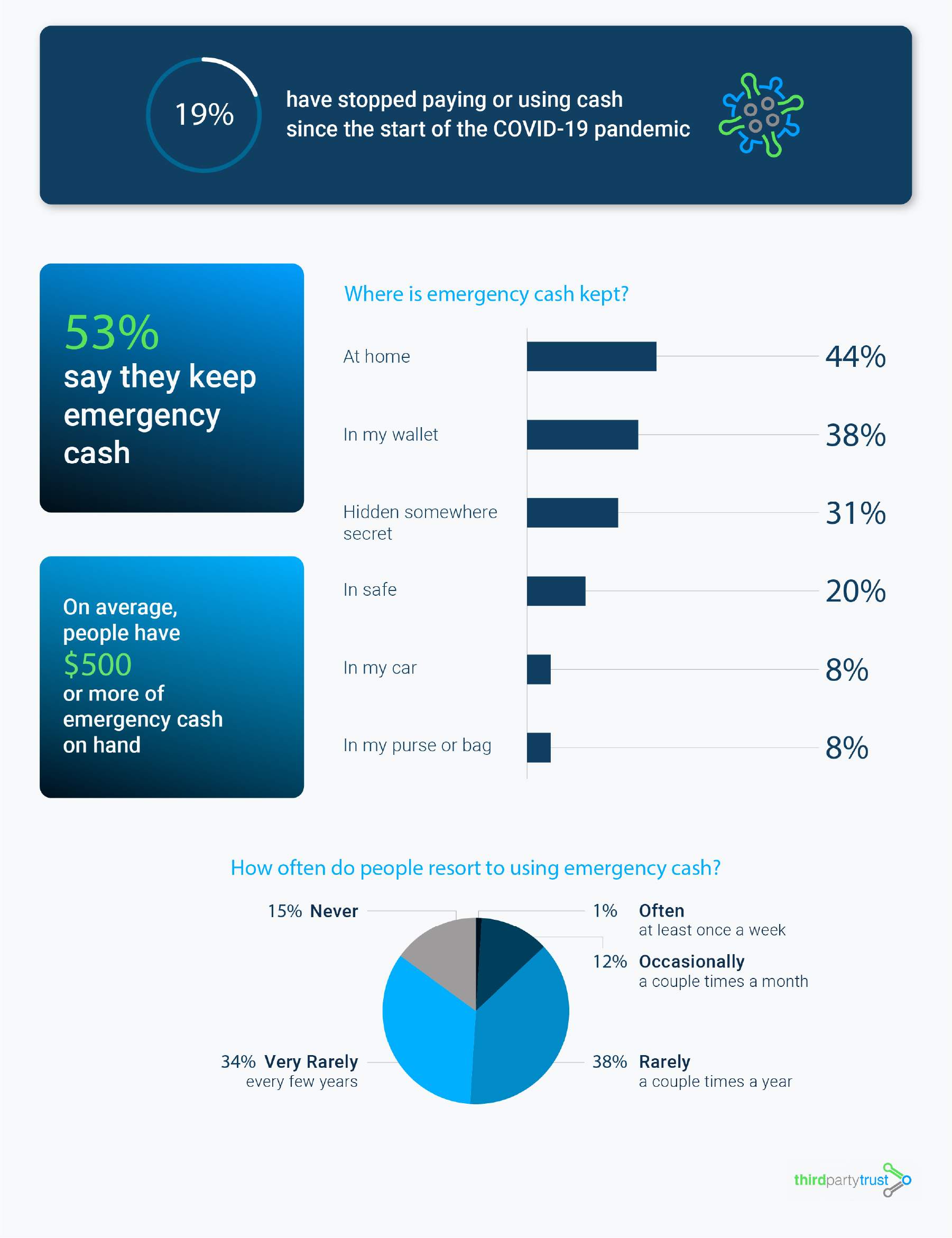

61% say they now wash their hands or use hand sanitizer after touching money. Almost one in five (19%) have stopped using cash altogether since the start of the COVID-19 pandemic.

The pandemic changed something else too: 41% say they judge cash’s appearance before touching it, and 36% of those say they won’t touch dirty or gross bills.

Despite not having paper bills on them all the time, more than half (53%) of Americans keep emergency cash at home. The average amount? $500. Luckily, 15% never touch their emergency cash. Almost three-quarters (72%) say they use it very rarely or rarely, and 12% use it occasionally. A mere 1% use their emergency cash stash at least once a week.

Even though many businesses shifted to cashless-only payments during the height of the pandemic, more and more are beginning to accept cash again.

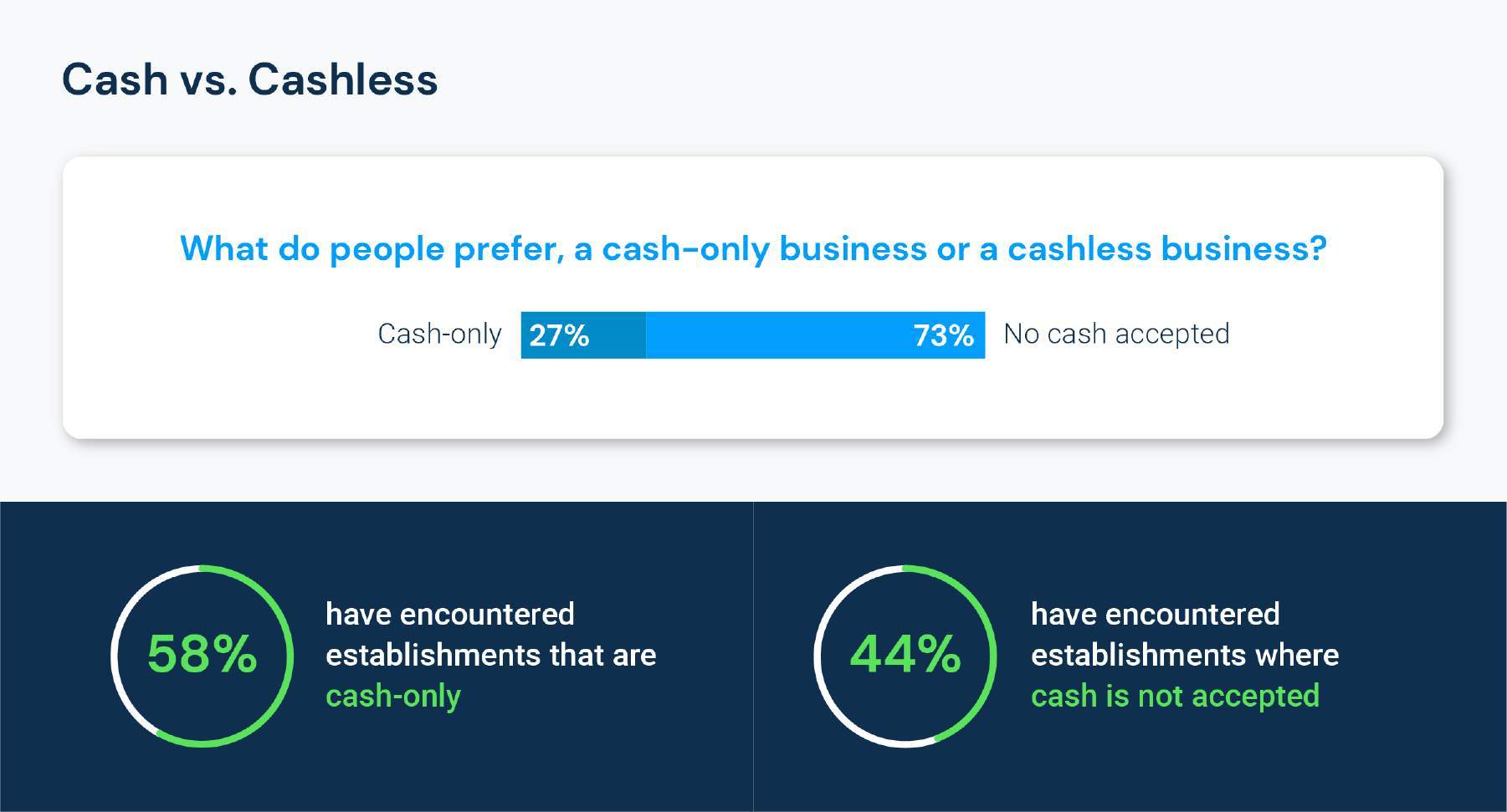

When asked what they prefer, 27% of customers say they prefer cash-only businesses, and a whopping 73% say they prefer a cashless business.

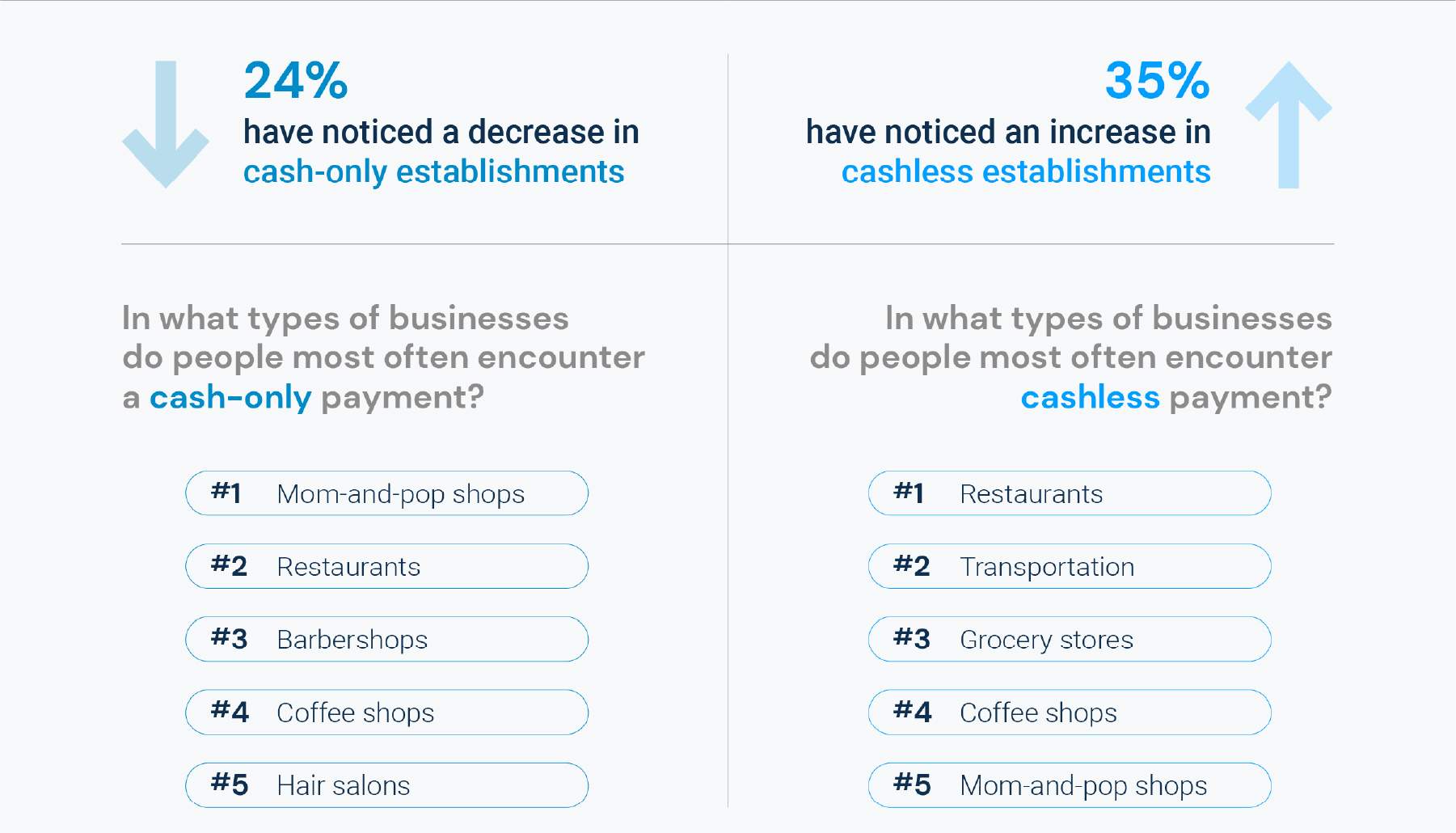

Despite their preferences, 58% say they’ve encountered cash-only businesses, versus 44% that have encountered no-cash businesses. Almost one quarter (24%) have noticed a decrease in cash-only establishments. It’s a good thing our parents told us to always keep some cash on hand!

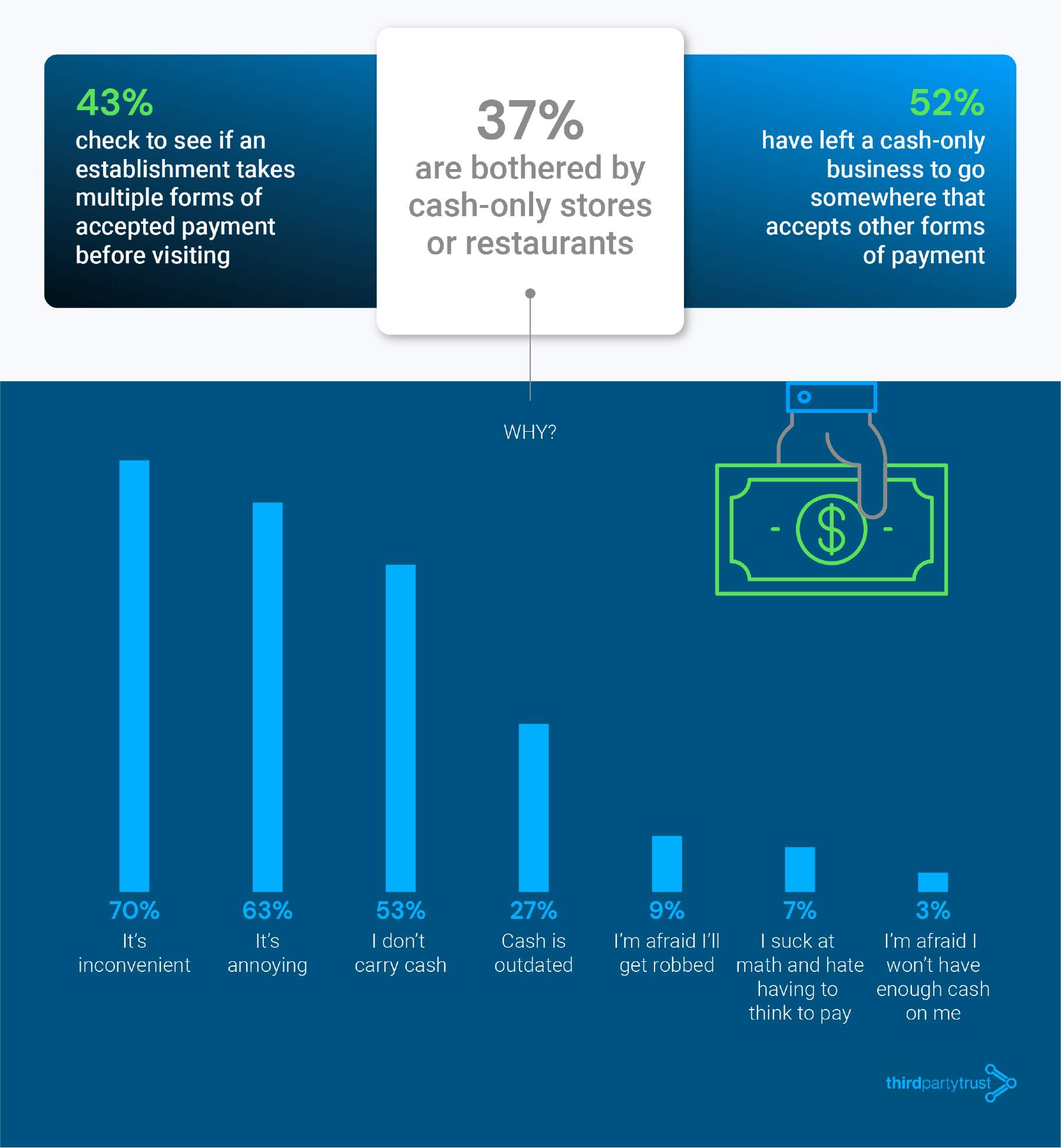

Similar to looking at a menu before visiting a restaurant, 43% of customers will check that an establishment accepts multiple forms of payment before visiting. 37% are bothered by cash-only stores and restaurants, and more than half (52%) have left a cash-only business to go somewhere else that takes digital or card payments.

Having access to your credit card on your phone or watch is a double-edged sword. Sure, it’s easy and convenient. But when it comes to spending, it’s almost too easy and convenient. There’s also security to think about too!

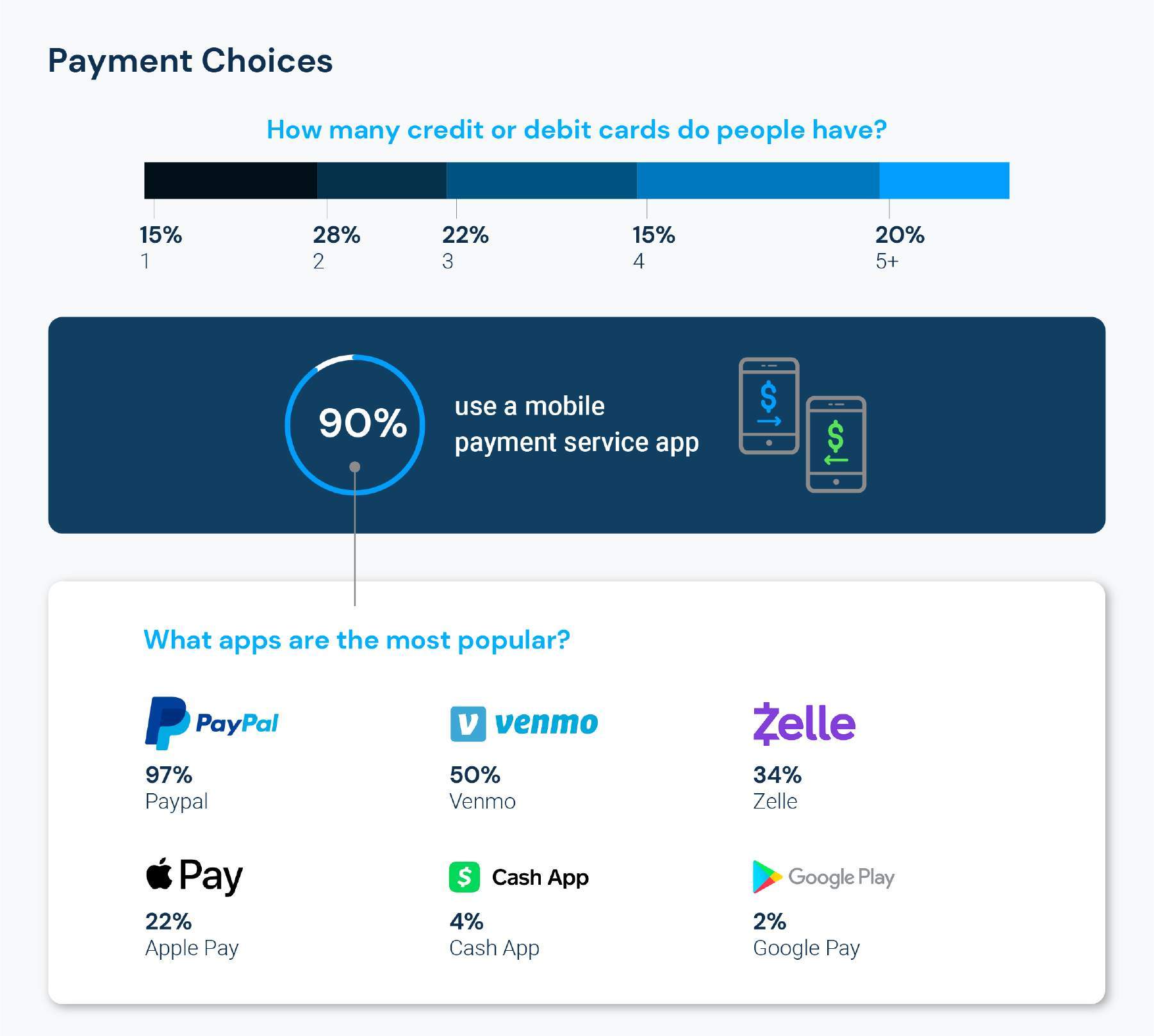

When asked if they use payment service apps, an overwhelming 90% say they do. The most popular is PayPal (97%) followed by Venmo (50%), Zelle (34%), and ApplePay (22%).

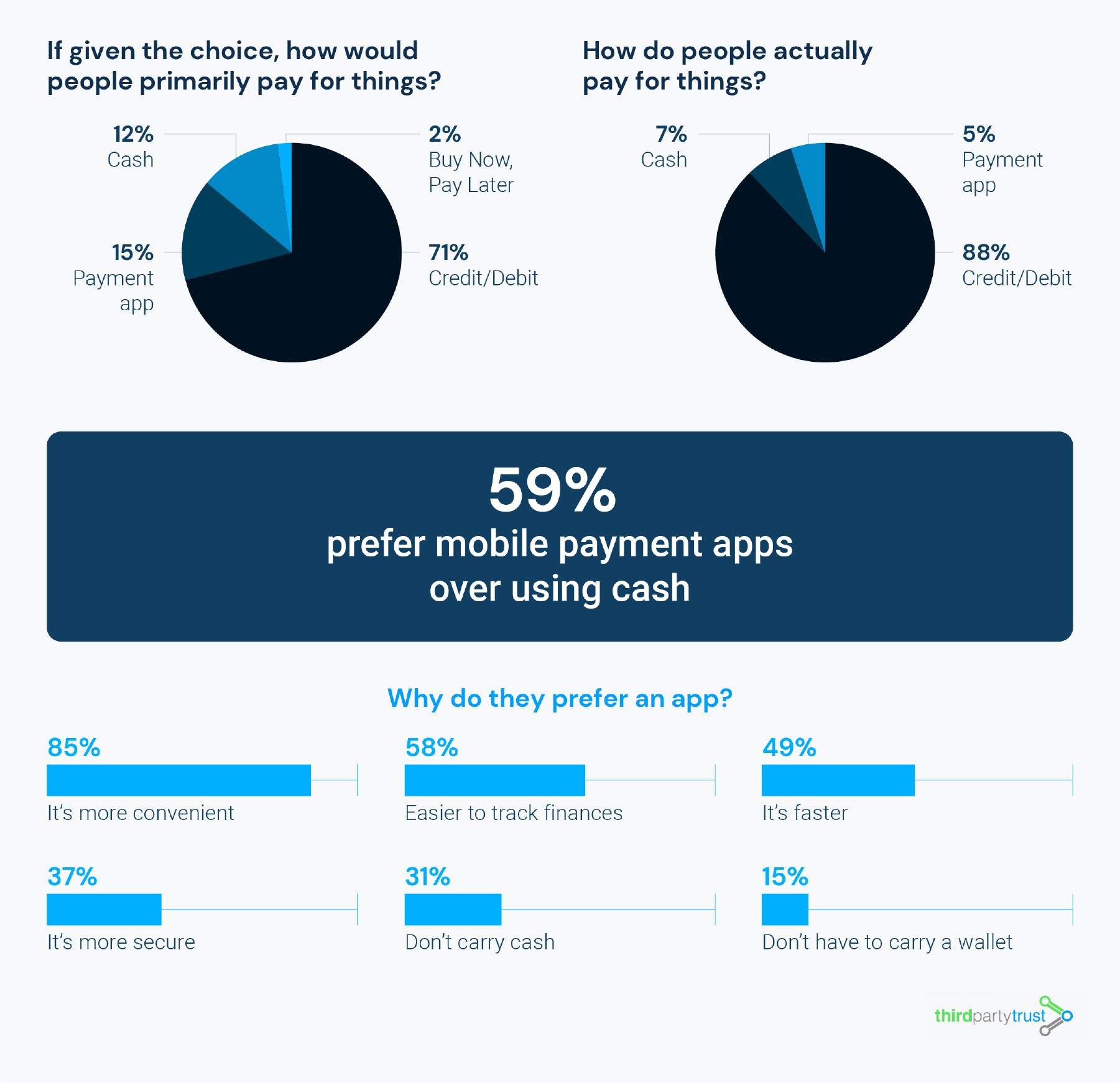

Most people (88%) use credit and debit cards to pay for things. Only 7% use cash and 5% use payment apps. If they had to choose, most (59%) say they’d prefer to pay through mobile payment apps over cash.

The way we spend our money and pay for things is changing. While many vendors adapted to cashless systems during the pandemic, it’s clear that many Americans are still using cash and plan to continue doing so.

So next time you step out for dinner or to pick up a last-minute gift, make sure you have at least a little bit of cash on you… just in case.

Methodology

In April 2022, we surveyed 1,117 Americans to get their feedback on using cash and the future of banking. Respondents were 48% female and 49% male, with an age range of 18 to 82 and an average age of 41 years old.

54% of respondents have a full-time job, 16% are part-time employees, 19% are unemployed and 10% report their employment status as “other.” The reported household incomes of respondents are under $20,000 (21%), $20,000 to $40,000 (20%), $40,001 to $60,000 (20%), $60,001 to $80,000 (14%), $80,001 to $100,000 (9%), and $100,001 or over (15%).

For media inquiries, contact media@digitalthirdcoast.net

Fair Use

When using this data and research, please attribute by linking to this study and citing www.thirdpartytrust.com